Mortgage Advice Essentials

CPD Accredited | Free PDF & Hard Copy Certificate included | Free Retake Exam | Lifetime Access

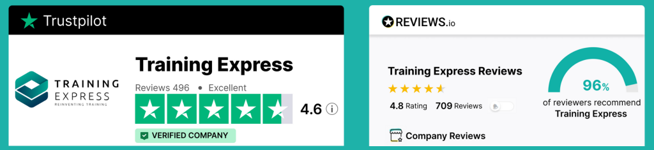

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Say goodbye to one-size-fits-all mortgages! We understand that each dream home is unique, and so are your financial goals. Our expert advisors craft personalised solutions that fit your lifestyle and aspirations, ensuring you're not just buying a house; you're investing in your future. From the very outset, immerse yourself in the intricacies of mortgage advisory with a riveting introduction that sets the stage for your exploration into the heart of this financial discipline.

Dive deep into the diverse tapestry of mortgage types and structures, unravelling the nuanced layers that define each. Gain invaluable insights through a meticulous analysis of the ever-evolving mortgage market, equipping yourself with the acumen needed to navigate its fluctuations seamlessly. Navigate the terrain of advice and recommendations, honing the skills required to guide clients through critical financial decisions with finesse.

Your journey extends into the intricate processes of documentation, ensuring you master the art of handling essential paperwork and procedures with precision. Dive into the critical domains of mortgage protection and insurance, understanding how these elements intertwine with the broader financial landscape. Grasp the regulatory landscape that governs this field, ensuring your practice aligns seamlessly with compliance standards.

Emerge not just as a mortgage advisor, but as a professional equipped with essential skills in client management, poised to build lasting relationships. Throughout this course, unlock the keys to success in this dynamic field, honing both your technical expertise and the interpersonal finesse necessary for thriving in the world of mortgage advice.

Key Features

- CPD Accredited

- FREE PDF + Hardcopy certificate

- Fully online, interactive course

- Self-paced learning and laptop, tablet and smartphone-friendly

- 24/7 Learning Assistance

- Discounts on bulk purchases

CPD

Course media

Resources

- Training Express Brochure - download

Description

Course Curriculum

- Module 1: Introduction to Mortgage Advice

- Module 2: Mortgage Types and Structures

- Module 3: Mortgage Market Analysis

- Module 4: Mortgage Advice and Recommendations

- Module 5: Mortgage Documentation and Processes

- Module 6: Mortgage Protection and Insurance

- Module 7: Mortgage Regulations and Compliance

- Module 8: Professional Skills and Client Management

Learning Outcomes:

- Analyse diverse mortgage types for client-specific recommendations.

- Demonstrate expertise in mortgage market analysis techniques.

- Navigate documentation processes with precision and efficiency.

- Develop and present comprehensive mortgage advisory strategies.

- Implement robust mortgage protection and insurance solutions.

- Ensure compliance with mortgage regulations through in-depth understanding.

Accreditation

This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field.

Certificate

After completing this course, you will get a FREE Digital Certificate from Training Express.

Who is this course for?

- Aspiring Mortgage Advisors

- Financial Services Professionals

- Individuals Seeking Financial Expertise

- Career Changers in Finance

- Banking and Finance Graduates

- Professionals Aiming for Regulatory Compliance Roles

- Individuals Entering the Mortgage Consultancy Field

- Anyone Eager to Master Client Management in Finance

Career path

- Mortgage Advisor

- Financial Consultant

- Regulatory Compliance Officer

- Mortgage Analyst

- Banking Specialist

- Insurance Advisor

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Digital certificate

Digital certificate - Included

Once you’ve successfully completed your course, you will immediately be sent a FREE digital certificate.

Hard copy certificate

Hard copy certificate - Included

Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK).

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.